Social Security COLA for 2026: What retirees can | Global Market News

In October, more than 70 million Americans will be taught how a lot their Social Security advantages will increase in 2026. The annual cost-of-living adjustment — higher often called the COLA — is projected to come back in round 2.5%, assuming inflation, as measured by the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), rises as anticipated during the third quarter of 2025.For the average retiree amassing simply over $2,000 monthly, that 2.5% adjustment would translate to an increase of roughly $50 monthly, or about $600 a 12 months. Not a windfall, however a welcome bump for these residing on fixed incomes.🏦 🏡 Don’t miss the transfer: SIGN UP for TheRoad’s FREE day by day e-newsletter 🏦 🏡But right here’s the catch: Medicare Part B premiums are going up, too. In 2026, the usual month-to-month premium is anticipated to rise by no less than $21.50. Since most beneficiaries have these premiums deducted immediately from their Social Security checks, the web increase in month-to-month income will seemingly be nearer to $28.50 — or about $342 for the 12 months.So whereas the headline COLA could also be 2.5%, the actual increase in take-home advantages — after accounting for Medicare Part B premiums — might be nearer to 1.4%.In different phrases, retirees will nonetheless get a raise, however inflation — and rising healthcare prices — will seemingly eat into the positive aspects.

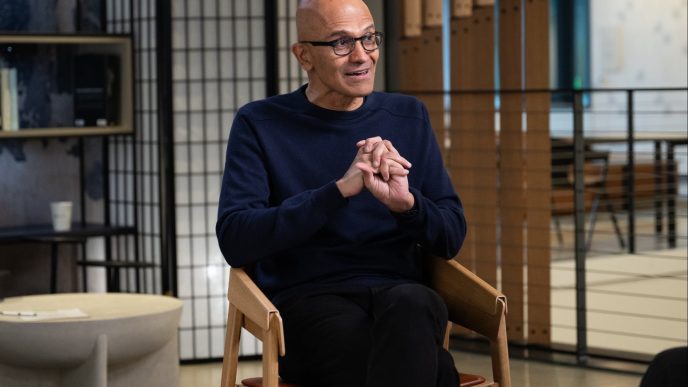

Medicare premiums will cut 2026 cost-of-living adjustment practically in half.Photo by bennett tobias on Unsplash

How Social Security calculates COLA A fast refresher: Legislation enacted in 1973 gives annual COLAs in order that Social Security and Supplemental Security Income (SSI) advantages keep tempo with inflation. The COLA is calculated utilizing a formulation within the Social Security Act, which compares the average CPI-W for the third quarter (July by means of September) with the identical quarter within the prior 12 months. The CPI-W for Q3 2024 was 303.420. The Bureau of Labor Statistics releases CPI-W knowledge month-to-month, and the official COLA for 2026 is anticipated to be introduced in mid-October.Related: Millions of Medicare beneficiaries may see main price shockFor 2025, the COLA was additionally 2.5%. Social Security advantages reflecting that increase started with the December 2024 fee, which was payable in January 2025. Federal SSI funds elevated by the identical quantity, efficient for funds made in January 2025. And as a result of January 1 is a vacation, SSI recipients noticed that bump of their Dec. 31, 2024, fee.The historic average COLA since 1975 has been 3.7%, but it surely has declined to 2.6% since 2000.

Social Security Cost-Of-Living Adjustments TableSSA

Of word, Social Security recipients receiving much less than about $800 monthly is perhaps affected by the maintain innocent rule if the 2026 COLA is 2.5%. The “hold harmless” rule sometimes protects Social Security advantages from being lowered by Medicare premium will increase if the COLA is not massive enough.AARP Survey: Americans fear about Social Security’s future — and its presentThis forecast in regards to the 2026 COLA comes on the heels of AARP’s release of a new survey marking Social Security’s ninetieth anniversary. The findings underscore growing nervousness about this system’s future and frustrations with its current.At a press convention this week, AARP CEO Myechia Minter-Jordan famous that more than 69 million Americans — more than one in 5 people within the nation — obtain Social Security advantages, whereas over 183 million employees are at present paying into the system.Among the important thing findings:

Related: Retired employees to see irritating change to Medicare in 2026The survey additionally spotlighted important customer support challenges on the Social Security Administration (SSA):

All in, the survey paints a image of widespread reliance on Social Security — and rising considerations about whether or not this system will proceed to ship, each now and into the longer term.More Social Security:

Stay up to date with the latest news within the international markets! Our web site is your go-to source for cutting-edge financial news, market trends, financial insights, and updates on worldwide trade. We present day by day updates to make sure you have entry to the freshest data on stock market actions, commodity costs, currency fluctuations, and main financial bulletins.

Explore how these trends are shaping the longer term of the worldwide economic system! Visit us recurrently for probably the most participating and informative market content material by clicking right here. Our fastidiously curated articles will keep you knowledgeable on market shifts, investment methods, geopolitical impacts, and pivotal moments in international finance.